Just when it seemed safe to talk about nukes again, price goes through the roof

A surge in the cost of small nuclear reactors has forced the national science agency to change its calculations for Australia.

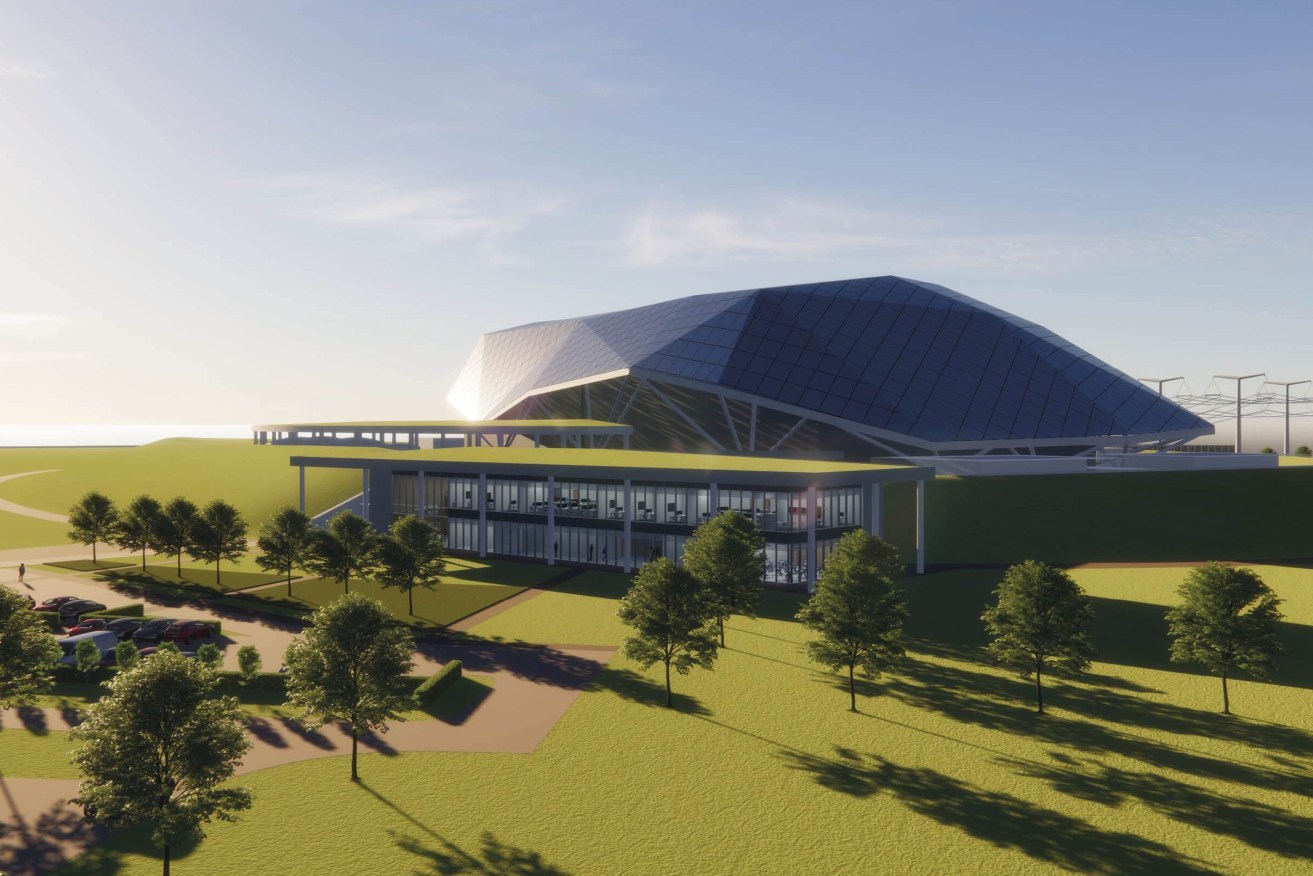

A rendering of the entrance of a Small Modular Reactor facility that Rolls-Royce SMR hopes to have operational by the end of the decade is seen in this handout render provided by Rolls-Royce SMR on Friday, Sept. 9, 2022. A global search for alternative sources to Russian energy during the war in Ukraine has refocused attention on smaller, easier-to-build nuclear power stations that proponents say they could provide a cheaper, more efficient alternative to older model mega-plants but detractors warn of heightened risks including the disposal of highly radioactive wave and the specter of nuclear weapons proliferation.

The latest modelling of all energy sources, released by CSIRO on Thursday, includes data from a recently scrapped project in the United States that was showcasing nuclear small modular reactors (SMRs) as a way to fight climate change.

The draft GenCost 2023-24 report, out for consultation over summer, shows that while inflation pressures are easing there has been a recalculation on SMRs that puts them out of reach.

Real data on a high-profile six-reactor power plant in the United States has confirmed that the contentious technology costs more than any energy consumer wants to pay.

Project costs for the Utah project were estimated at $18,200 per kilowatt, but the company has since disclosed a whopping capital cost of $31,100/kW, prompting its cancellation in November.

In contrast, under existing policies the cost of new offshore wind in Australia in 2023 would be $5545/kW (fixed) and $6856/kW (floating), while rooftop solar panels are calculated at a modest $1505/kW.

The GenCost report is an annual update of the costs of electricity generation, energy storage and hydrogen production, which attempts to build in the transmission and integration costs.

As a benchmark, the final report for 2024 will guide government and investor decisions about how to meet climate pledges and create the lowest-cost electricity grid for Australians.

Amid a global inflation bubble, capital costs for most energy technologies rose by 20 per cent in 2022, including nuclear.

The latest figures show increases of up to 14 per cent for gas turbines, eight per cent for onshore wind (down from a 35 per cent spike in 2022), two per cent for big batteries and a fall of eight per cent for solar farms.

Of the fossil fuel technologies, CSIRO said it was difficult to say which was more competitive as it depended on contracts for long-term fuel supply and the investor’s perception of climate policy risk.

A small but vocal group of industry backers have been calling for nuclear SMRs for some years, citing the emerging low-emission technology as being suitable for Australia’s vast and geologically stable landmass.

The coalition recently pledged to reopen the nuclear debate in Australia, where laws ban any research or use of nuclear energy despite the country having the world’s largest uranium reserves.

Regulators estimate it would be around 15 years to first production from a decision to build nuclear SMR in Australia, given the scale of legislative change required.

But even if a decision to pursue a nuclear SMR project in Australia were taken today, with political backing for new laws, it is “very unlikely” a project would be up and running as quickly as 2038, CSIRO said.

Further, CSIRO warned nuclear electricity costs put forward by proponents may be for technology that is not appropriate for Australia, or calculated from Russian and Chinese government-backed projects that don’t operate commercially.