Lowe still on the shortlist as Chalmers prepares to name new RBA boss

A call on the future of the Reserve Bank’s leadership will be made soon as the treasurer and his colleagues consider a shortlist of qualified candidates.

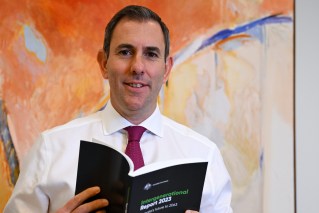

Governor of the Reserve Bank of Australia (RBA) Philip Lowe remains on the short list to retain his role.. (AAP Image/Lukas Coch)

Treasurer Jim Chalmers said he would take a recommendation on the RBA governor’s post to cabinet for discussion “before long” and he planned to make an announcement immediately afterwards.

Current governor Philip Lowe’s term is due to expire within months and speculation is mounting that his tenure will not be renewed.

But the treasurer said Dr Lowe remained on the shortlist, although other possible appointees such as Treasury boss Stephen Kennedy and RBA deputy governor Michele Bullock would also be qualified to do the job.

“This is one of the most important appointments that the government will make, and it’s a big job … it’s a big call,” Dr Chalmers told ABC radio on Wednesday.

He also confirmed he’d spoken to shadow treasurer Angus Taylor about the future of the RBA’s leadership.

“We’ve got our fair share of differences, but on the Reserve Bank our interests are aligned in wanting to make sure that we make a good appointment here,” Dr Chalmers said.

Members of the opposition have expressed their support for the existing governor, with finance spokeswoman Jane Hume arguing he was “doing his job” by lifting interest rates to tackle inflation and his reappointment would be supported.

Dr Lowe is due to make a public appearance on Wednesday at a lunch hosted by the Economic Society of Australia.

He is expected to speak on the review of the central bank and monetary policy.

Following the address, Assistant Competition Minister Andrew Leigh will deliver a speech about one of the hurdles the RBA faces to bring inflation back within its target band.

While the Russian invasion of Ukraine and global supply chain problems were key drivers of Australia’s inflation problem, a lack of competition was also impeding the usefulness of interest rates to drive prices down.

Dr Leigh will tell the conference two pieces of research, published in the American Economic Review Papers and Proceedings, suggest monopolies make it harder for central bankers to achieve their aims.

He says Australia has seen a rise in market concentration and mark-ups, while its biggest firms have more power to push prices up and to keep wages down.

This creates two problems: a higher burden on young, low mark-up firms and the central bank pushing unemployment higher than it would if there were plenty of healthy competition between employers.

“If a lack of competition makes monetary policy less effective, then this can have both efficiency and equity costs – impeding growth and harming fairness,” he will say.

“If you care about central banks being able to do their jobs, then you should care about a competitive and dynamic economy.”