BoQ investors laughing as profits jump on boom in home lending

Bank of Queensland investors will get a windfall dividend after the company reported a 66 per cent increase to its bottom line interim profit of $154 million.

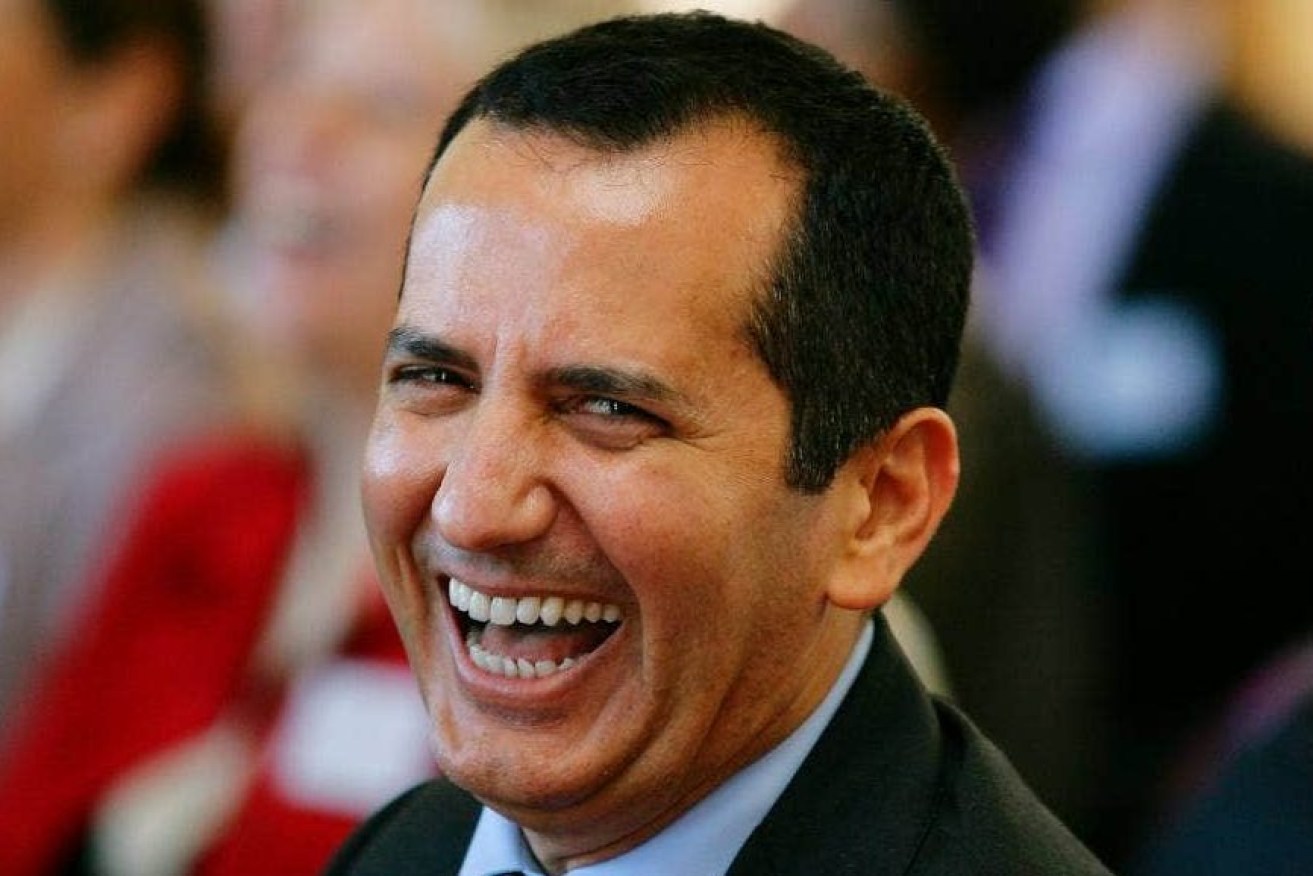

Bank of Queensland managing director George Frazis will be replaced after three years in the role. (file image)

The bank reported a strong turnaround in its retail business which it said underpinned a dividend payout of 17 cents a share, up from 11 cents last year when dividends were restricted.

Chief executive George Frazis said the BoQ homebuying transformation program had led to increased lending growth to just under $1 billion in net housing gross loans and advancements.

“Our home buying transformation program has resulted in application volumes increasing significantly and we have maintained good ‘time-t0-conditional-yes’ despite the increased volumes,” Frazis said.

“This has seen our housing loan growth accelerating and improvements to the mortgage customer experience has seen our BoQ retail mortgage net promoter score now ranked third, up from 11th in 2019.”

Customer deposits increased by $1 billion during the half which allowed the bank to reduce its reliance on more expensive types of funding such as term deposits. This also helped increase the net interest margin.

BoQ said arrears in the housing and commercial portfolios had improved. About 95 per cent of loans on relief packages and 97 per cent of SME loans had now returned to performing status.

“The economic outlook appears more positive and is showing encouraging signs of improvement,” Frazis said.

“Australia is well placed for economic recovery with less likelihood of negative impacts on unemployment and house prices given the success of government stimulus.

BoQ is expecting the takeover of ME Bank to be completed in the second half.