‘Transformational’ – how BoQ takeover turns it into $88 billion powerhouse

Bank of Queensland has come back to life after years of underperformance with a $1.3 billion deal to buy ME Bank that would give it $88 billion in assets and double its retail business.

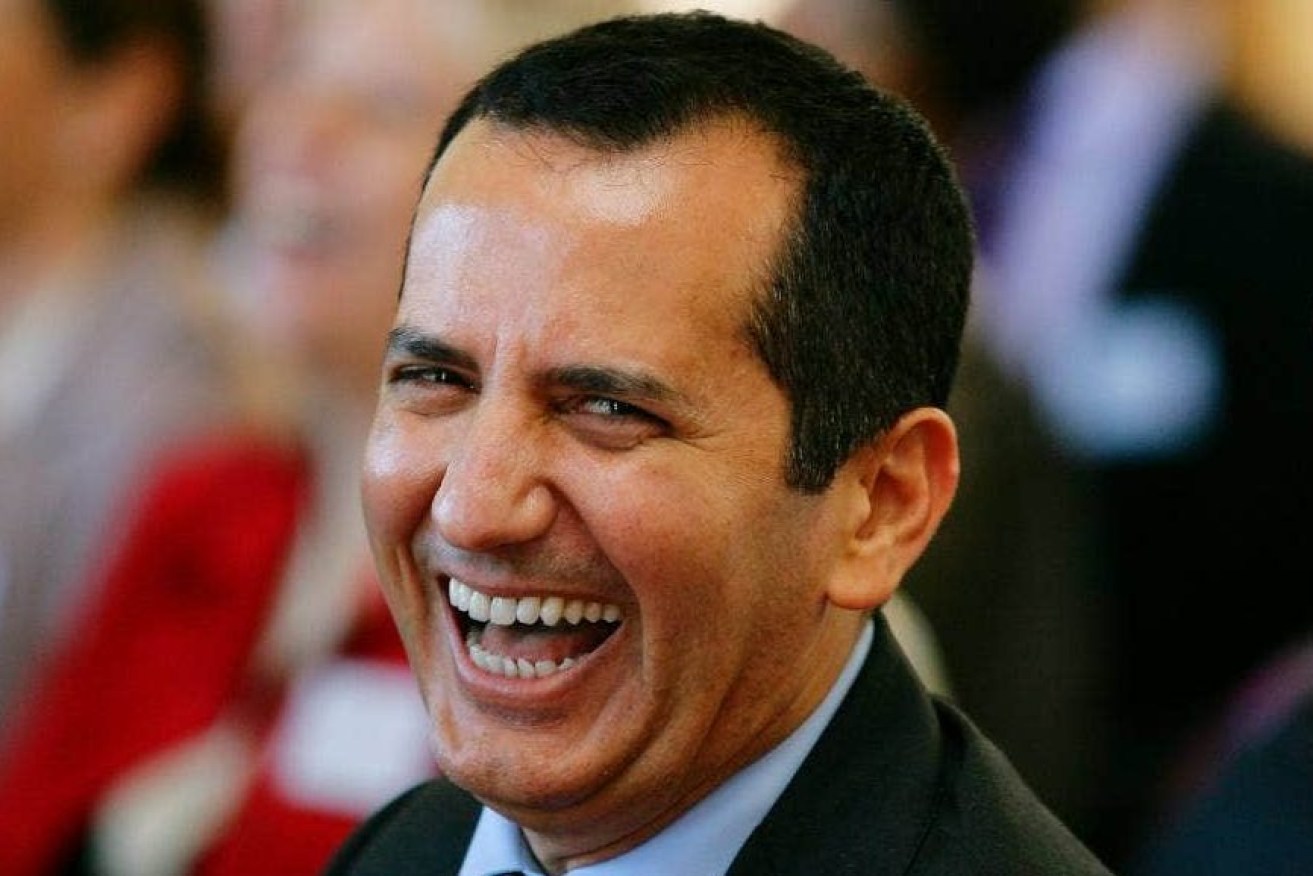

Bank of Queensland managing director George Frazis will be replaced after three years in the role. (file image)

The deal is key to the revitalisation of the bank which has suffered a sliding profit and share price in recent years. BOQ brought in managing director George Frazis in 2019 from Westpac and St George as a turnaround agent.

Frazis described the deal as transformative and that he was “truly excited” about the agreement which has been forecast to deliver a full-year cash net profit of $442 million and make it more competitive with the big banks.

He said the most important issue in the deal was the boost to scale. Its customer base will grow from about 900,000 to 1.54 million. The merged company would have about $56 billion in deposits and its retail business would be double its current size.

BoQ will now have three brands with ME Bank and Virgin Money and will be geographically more diverse.

The deal will call on shareholders in a 1 for 3.34 accelerated, non-renounceable entitlement offer to raise $1 billion. There will also be a $350 million underwritten, institutional placement.

“This is a defining acquisition in our ongoing transformation of BoQ, benefitting our shareholders, customers, and people,” Frazis said.

“The ME Bank brand is also a great fit with the BoQ and Virgin Money brands, creating customer-centric alternatives in Australia.

“It is an exciting day to see two strategically and culturally-aligned businesses come together and we look forward to continuing to build ME Bank’s strong brand, accelerate growth and create new opportunities for our people and the Group.

The acquisition is expected to positively impact earnings share in its first year.

It expected a strong first-half operating and financial result with its first-half net profit growth of 60 per cent to 65 per cent and cash net profit growth of 8 per cent to 10 per cent.

Synergies were expected to be up to $80 million and Frazis said the transformation of BoQ was well underway.

“If you go back 18 months BoQ was going backwards in mortgages. In 18 months we have been able to turn that around, ” Frazis said.

“We do intend to invest heavily in this business over the next three years. ”

That could cost $500 million over that three years.

ME Bank is currently owned by 26 industry super funds.