Uninsurable nation: What happens when insurance costs so much that nobody can afford it?

Future Disaster Insurance Cover will come at a premium so high, only governments can foot the bill, writes Greg Hallam

The north west has been inundated (AAP Image/Murray McCloskey)

A new book entitled Disaster Insurance Reimagined, published by Oxford Press, makes the case that the private insurance market will no longer be able to offer disaster cover, and that’s bad news for Queenslanders right across the state

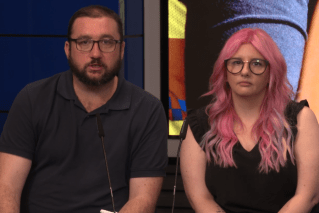

As tough as insurance premiums are now , they will literally become unaffordable over the next decade according to the books four authors, which includes the University of Queensland’s own Dr Paula Jarzabkowski.

This new book comes on the heels of the Australian Insurance Councils advice and warning in the Insurance Catastrophe Risk and Reliance Report 2022-23, released earlier this week, that insured losses for the last financial year amounted to $7b based on 302,000 claims, and some insurers were leaving the market.

To top it off, a 2022 Climate Council Report entitled Uninsurable Nation found that five of the 10 most at risk communities in Australia were located in Queensland. Sadly we are disaster central.

It’s hard to imagine that by 2035, if not earlier, a major cyclone and/or flood could leave thousands upon thousands of Queenslanders uninsured or underinsured and not able to repair physical damage to their homes and businesses – but that’s the stark reality.

At the time of the last Federal Election there were 15,000 homes north of the Tropic of Capricorn that were uninsured, a veritable ticking time bomb.

According to Jarzabkowski and others, Climate Change and increasing urbanisation around the world is making insurance policy holders, some areas, and even some disasters uninsurable.

The traditional private insurance market is failing, pure and simple. For a lot of us that reality is reinforced by the nightly television news with a world beset by natural disasters and the calamity that follows.

A little-known reality is that most of the insurance risk is held off-shore by the re-insurance market, principally in London and Bermuda.

The insurance company names that Australians are most familiar with operate in the retail side of insurance, and/or with limited exposure to catastrophe level risk. It’s the so-called Re’s where the buck literally stops and players are exiting the market in droves, based on a planet heating up by a forecast 2.5 to 2. 9 degrees.

Yes, the insurance retailers are making money, but the reinsurers aren’t – indeed they have suffered $50b losses each of the last two financial years.Without reinsurers, there is no retail market .

There is hope though, in the form of new national level public/private partnerships in the insurance world that shore up the faltering market. Many national governments are being forced to innovate to protect their citizens.

Enter the Federal or Commonwealth Government with its massive fiscal capacity to help provide property insurance into the future. It’s now even beyond the State Governments to individually or cumulatively bear that financial burden. The days of the SGIO are long gone and the word Commonwealth says it all.

The Australian Government is already the major funder of public disaster reconstruction, footing 75 per cent of the bill . It’s a further jump to the left to contemplate funding private or house/property insurance by way of re-insurance support private or household insurance, but that’s what’s needed.

To my mind the Federal Government will have to consider altering taxation levels, as they did to pay the bill for the 2011 floods.

But at the same time they don’t want to create a nanny state and absolve citizens from making real contributions to protecting their own assets. It’s being done overseas and we need to get cracking here in Australia.

One thing is for sure – no government, at any level, will survive the politics of large swathes of cities, towns and small communities being uninhabitable after a major natural disaster. Game on .

Greg Hallam is a former Chief Executive Officer of the Local Government Association of Queensland.