Charleville’s charms attract virus escapees fuelling outback property boom

New research shows property owners have almost doubled their investment in the last two years, with once struggling rural towns sharing in the spoils.

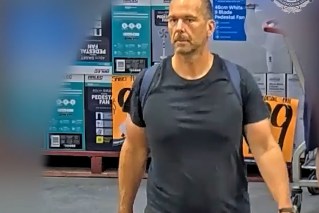

The Corones Hotel in Charleville, which is enjoying a property boom. (Photo: Tourism Queensland)

The western Queensland centre of Charleville has ranked fourth on an REA Group survey of housing prices in the post-Covid real estate boom in Queensland.

Coastal centres such as Miami on the Gold Coast and Sunrise Beach and Sunshine Beach on the Sunshine Coast head the list of prized locations, recording median prices of $1.48 million, $1.65 million and $3.345 million at a change of 93 per cent, 89 per cent and 86 per cent respectively.

But close behind the seaside locales that surf on their ocean views and tourist economies is Charleville at a return of 82 per cent, outstripping other regional centres and city suburbs, despite being a nine-hour drive from Brisbane.

And in contrast to the top three, a house in Charleville will only set you back $152,000, making it a more attractive option for more investors, according to the region’s proud mayor Shaun “Zoro” Radnedge.

The leader of Murweh Shire Council attributes the “fantastic” result to what he describes as a “regionalisation-focused investment strategy”.

“Given the price difference between us and the other three suburbs shows there is no better place in the region to invest when it comes to affordability,” he said.

“We’ve seen a major turnaround in the last 18 months with the council implementing its investment strategy to general investor interest.”

He said the council would soon release 11 blocks of land for tender in the $10,000 to $30,000 range, with hopes to secure three executive housing developments under a flexible 15-year payment arrangement.

The lift in fortunes for towns like Charleville, show locations far off the coast are not being bypassed in the rush for property outside cities that has intensified since Covid.

Demographer and social commentator Bernard Salt joked at a recent business breakfast hosted by the investor platform AltX that the shift in buying behaviour could be summarised as VESPA: Virus Escapees Seeking Provincial Australia.

He said regional Australia was winning from buyers who were seizing the opportunity to work from home within striking distance of a major capital city or centre.

Radnedge said he had observed a similar sentiment in his own community, with recent investor interest spiked by young people coming to the region to secure a better lifestyle in smaller, supportive communities.

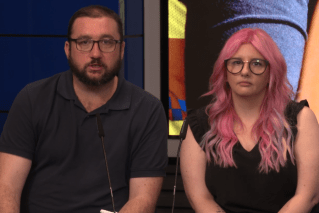

“We had one couple in their 30s sell their home in Wollongong to buy a house here,” he said.

“Instead of being lumped with a 30-year home loan, they now have $300,000 in the bank.

“With young people investing in the region comes more demand for infrastructure and potential for jobs for teachers, nurses, and other professionals in the future.”

While surging interest in rural property has an upside for investors and those in a position to buy, soaring prices continue to apply pressure on landholders facing climbing rates on the back of new land valuations.

The state’s valuer-general released new valuations for 30 local government areas last week, with some of the highest increases recorded in the state’s remote north-west at Boulia (350 per cent), Burke (328 per cent), Carpentaria (335 per cent), Croydon (222 per cent), and Etheridge (192 per cent).

Objections to the increases can be lodged by May 30.