New thread: Why cotton farmers are keen to stitch up fresh fields in north

Areas of northern Australia are being eyed as potential new fields to grow cotton in a bid to capitalise on rising global demand.

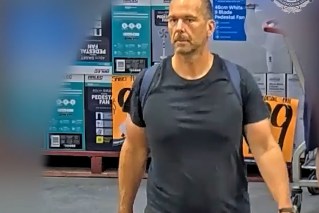

Cecil Plains cotton grower Tyson Armitage is getting ready for a big plant in October.

Upbeat farmer Tyson Armitage has every reason to smile.

In little more than a month, he and his dad, Stuart, a former Queensland Farmers’ Federation president, will be planting cotton crops on their 700-hectare farm near Cecil Plains to take advantage of the best growing conditions they’ve seen in years.

“It’s looking decent,” Tyson Armitage told InQueensland this week as he surveyed his fields ahead of planting in late October.

“The last few years have been tough with less than average rainfall but we’ve had generally good yields due to the warmer weather.

“Last year was especially tough but we managed to maximise our yields on a smaller area due to decent rain in January and February.”

In a state that promotes its abundance of sunshine, cotton should be the ideal crop for Queensland.

Plenty of sunny days through summer and balanced nutrition by way of fertiliser application are key ingredients for a healthy crop through until harvest.

But it also needs water. In the largely tinder-dry regions where it’s currently grown, where river systems are under stress and farmers of food crops hotly compete for water, that’s where cotton can come unstuck.

On the Armitage property on the inner western Darling Downs, they use about 3-4 megalitres of water per hectare of cotton, primarily sourced from bore water.

Since starting cotton production in 1994, the Armitages have also reduced fertiliser use, basing their nutrition program on naturally occurring manures and dropping their nitrogen rates.

“Our average yields have been trending up each year and our water use or megalitre per bale of cotton has been going down and getting more efficient for our minimal water,” Tyson Armitage says.

Located in a district 80km west of Toowoomba and hard-hit by drought, the Armitage property has an annual average rainfall of 600mm.

Last year they received 160mm but this year it has rebounded to 500 mm to the end of August, a key reason why Tyson Armitage is counting the days until he gets his planters ready.

While spirits might be high on the Armitage property, it’s the cycle of boom and bust on the capricious tide of variable rainfall that’s leading one analyst to look further north for new areas of cotton cultivation – regions where rainfall can produce more consistent volumes to satisfy growing global demand over the next decade.

Mainly grown in central and southern Queensland and north-west NSW, cotton yields and fortunes take a hit when rainfall is low, not to mention the battering the industry cops when inflows to river systems plummet and irrigators are left to fight over the water market’s meagre remains.

Despite documented evidence that it now takes 48 per cent less water, 34 per cent less land and 97 per cent lower insecticide rates to produce one bale of cotton than in 1992, cotton remains an easy and large target when the debates rage about farming’s impact on the environment.

In the face of such challenges, Rabobank analyst Charles Clack has written a detailed report on the proposal to expand rather than shrink cotton’s footprint, touting Broome and Kununurra in Western Australia, Douglas Daly and Katherine in the Northern Territory and areas around Georgetown in far northwest Queensland as prime prospects for a future in cotton, with water the key attraction.

He says that with a latitude similar to Brazil’s rapidly-expanding Mato Grosso cotton region, northern Australia may reshape future domestic output potential.

The outlook is based on several assumptions, most notably predicting what path demand for cotton will take post the pandemic and whether selling cotton’s credentials as an environmentally sustainable crop will convince a sceptical public.

Global cotton demand is already down an estimated 13 per cent on last year, with consumption unlikely to fully recover from the impact of COVID-19 until 2021-22, and that’s assuming widespread relaxation of virus restrictions, Clack says.

If COVID-19 is constrained post-2022, then Rabobank is forecasting 1.1 per cent – or 13 million bales – growth in global cotton consumption year-on-year thereafter through until the end of the decade.

“Our modelling suggests Australia has the opportunity to increase its export volumes to over five million bales through the next decade, if production allows, with South-East Asia an attractive market,” Clack concludes.

Prospects heading north

Capitalising on growing export opportunities in the face of competition from India and Brazil, who produce high volumes but inconsistent quality based on rain-fed systems, means sourcing country capable of carrying irrigation.

Clack calculates a rise in area of 540,000 hectares, assuming 90 per cent irrigated, coupled with yield increases from current plantings, as crucial to achieving a target of 5.3 million bales.

To put that increase in perspective, peak producer group Cotton Australia is forecasting a 2 million-bale crop for the 2020-2021 cotton season, still about 1 million bales short of the national average.

That volume will come from 160,000 hectares of irrigated country and 22,000 of dryland cultivation across NSW and Queensland.

It’s a significant challenge to lift yields in the millions, especially as farmers shift their “water-purchasing power” towards permanent crops such as fruit and nut trees and berries where margins are relatively higher.

Clack cites the slowing of cotton’s expansion into southern NSW during the past decade on the Lachlan and Murrumbidgee Rivers as a case in point.

“Looking to 2029-30, cotton will remain an important part of the agricultural system in the southern Murray Darling Basin, and we expect capacity of over one million bales in times of surplus water,” Clack said.

“However, we forecast limited structural expansion in the region, and cotton margins will need to be convincing compared to summer crop alternatives in order for seasonal acres to expand.”

In contrast, northern Australia offers better margins when compared to other crops due to higher water availability and land at lower cost, despite the huge distance from current ginning infrastructure at Emerald and Dalby.

The high capital entry requirements in order to access specialised cotton equipment, machinery, inputs and talent in the north, plus distance to regional centres for agricultural services, were also challenges facing northern development.

“The long-term potential for the Fitzroy, Darwin, and Mitchell catchments total 360,000 hectares of irrigated potential,” Clack says.

“Adding the Ord River Irrigation Scheme provides a potential 420,000 hectares of irrigated agriculture – which, when compared to the Murray-Darling Basin’s 1.6 million hectares of irrigation in 2016, is huge.”