We’re in recession: Treasurer delivers bad news as nation’s 29-year winning streak ends

Treasurer Josh Frydenberg has confirmed Australia is now in a recession as the economy reels from the coronavirus pandemic.

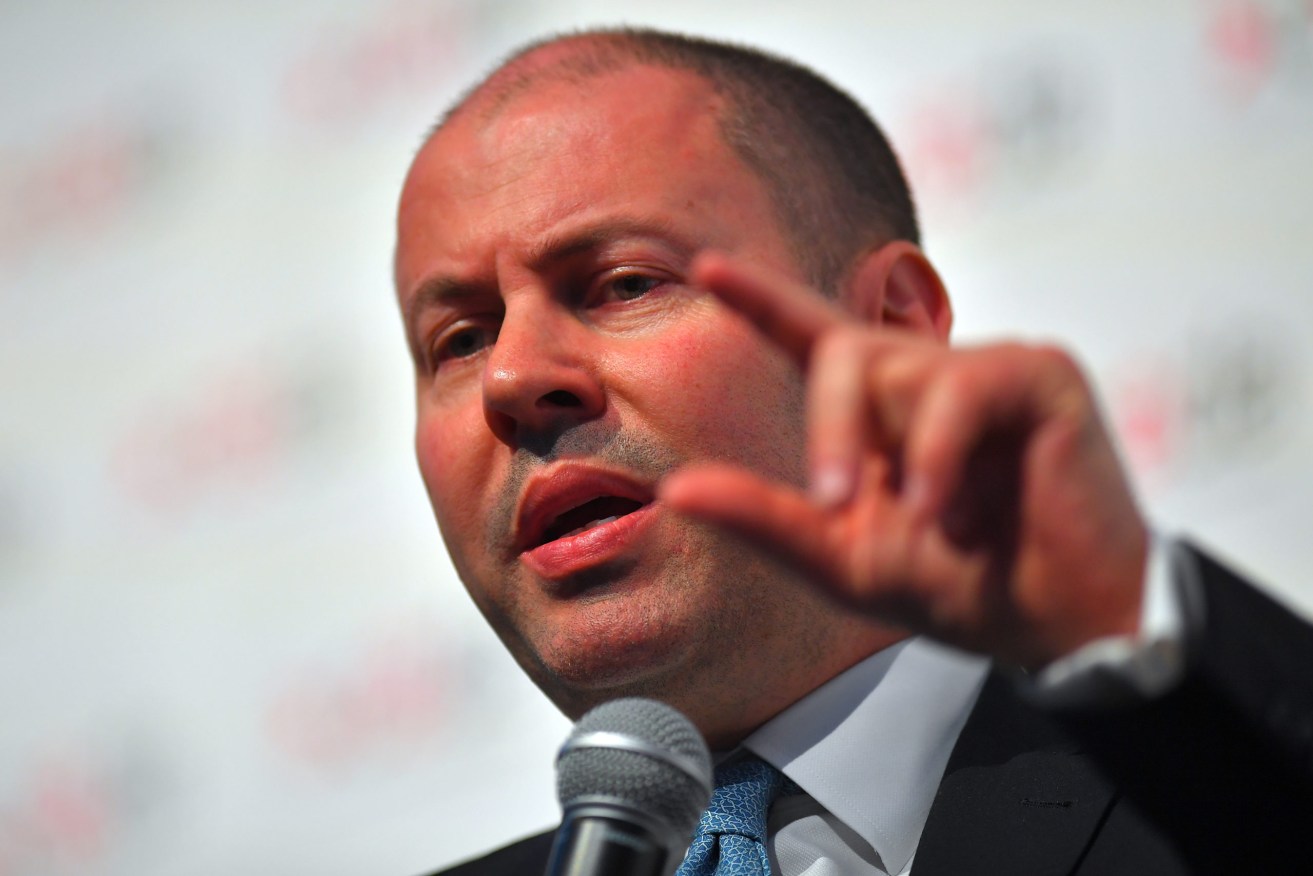

Federal Treasurer Josh Frydenberg (Photo: Steven Saphore/AAP PHOTOS)

Frydenberg’s confirmation came after the Australian Bureau of Statistics reported the economy shrank by 0.3 per cent in the March quarter, on the back of the bushfires, drought and coronavirus pandemic.

Asked whether the country was now in recession, he said: “Well, the answer to that is ‘yes’. And that is on the basis of the advice that I have from the Treasury department about where the June quarter is expected to be.”

The news came as Industrial Relations Minister Christian Porter joined union heads Sally McManus and Michele O’Neil and a range of employer groups in Sydney on Wednesday morning.

The groups are looking at issues including the definition of casual employment, enterprise agreements for major projects and simplifying awards for hard-hit industries such as hospitality.

They have been given until September to come up with a range of solutions.

“I would summarise today as a very optimistic start to the process,” Porter told reporters.

Porter said Labor won’t be part of the working groups after they criticised the initiative.

“We’re only interested in individuals and groups who want to engage constructively in the job growth agenda,” he said.

Australia’s economy contracted 0.3 per cent in the March quarter, according to new economic figures.

Gross domestic product grew just 1.4 per cent in the 12 months to March 31 as the economy took a hit from the bushfires and the beginning of the coronavirus crisis, the Australian Bureau of Statistics says.

“This was the slowest through-the-year growth since September 2009 when Australia was in the midst of the global financial crisis and captures just the beginning of the expected economic effects of COVID-19,” ABS chief economist Bruce Hockman said on Wednesday.

“I think it’s the sort of story we were anticipating,” said St George chief economist Besa Deda.

“It looks a lot better than some of the other economies around the world” and better than what economists had anticipated earlier, Deda said.

The Australian dollar jumped on the news, rising to a five-month high of 69.84 US cents, although by 1327 AEDT it had eased to 69.35 US cents.

While it was Australia’s first quarterly economic decline since March 2011, economists took heart that the contraction wasn’t worse.

“The economy was hit by bushfires, drought, cyclones, flooding and a global pandemic and only fell 0.3 per cent,” CommSec chief economist Craig James said.

That represents just a 1.2 per cent fall at an annualised rate, compared with the 5.0 per cent annualised contraction the United States economy suffered in the March quarter, a 7.7 per cent per cent decline in the UK, 8.6 per cent in Germany and 33.8 per cent in China, James said.

Economists had said there was an outside chance the readout would be flat or positive.

That would have given Australia the chance to extend its unprecedented run of more than 29 years without a recession, which economists define as two consecutive quarters of economic contraction.

With Australia’s economy certain to shrink this quarter – economists say it will likely be the most severe contraction since the Great Depression – it’s clear that Australia will officially record its first recession three decades years when the next GDP figures are released in September.

“Today’s data confirm the pandemic pushed the economy into a deep recession in March,” said NAB economist Kaixin Owyong, who is expecting a “massive” 8.4 per cent fall in June quarter GDP.

“Interesting that it took a healthy emergency to break the record economic expansion,” Mr James said.

Westpac economist Andrew Hanlan said the key downside surprise in Wednesday’s figures was that consumer spending dropped 1.1 per cent, detracting 0.6 percentage points from GDP.

“While retail rose, spending in other areas was hard hit by the pandemic,” Mr Hanlan said.

While spending on goods rose – notably on food, medicine and home office equipment – spending on services such as travel, dining and recreation fell sharply, by 1.9 per cent overall in the biggest decline since the 1980s.

Home building and business investments were down, as were business inventories as the pandemic disrupted supply chains.

Overall private demand subtracted 0.8 percentage points from GDP while public demand contributed 0.3 per cent percentage points to it, with government spending rising 1.8 per cent as authorities responded to the bushfires and the COVID-19 pandemic.

BIS Oxford Economics chief economist Sarah Hunter said she expected the decline in first-half GDP to be “relatively small when compared with other economies – we now expect the peak to trough fall in GDP to be significantly less than 10 per cent”.

“It’s still going to be substantial,” she said.

Treasury officials and other bureaucrats briefed the meetings on the scale of the challenge facing each sector.

Federal cabinet is expected to consider targeted support for two sectors – construction and the arts – with announcements anticipated this week.

The government is considering a plan for cash grants to build new homes or for major renovation projects to stimulate domestic building jobs.

Frydenberg said the feedback had been positive so far.

“We think, based on the consultations we’ve had with the sector, that this will be a very welcome initiative which will support new builds and will also support extra economic activity and therefore more jobs,” he told reporters in Canberra.

Even before full details are known, it has come under fire from Labor.

The Opposition said the money would be better spent on social housing, including maintenance and upgrades to existing properties.

-AAP