Insurance market unfair and unprofitable so RACQ calls it quits

RACQ has followed up its threat and declared it would withdraw from the Queensland’s compulsory third party insurance market, claiming it was unfair and carried too big risk for the company.

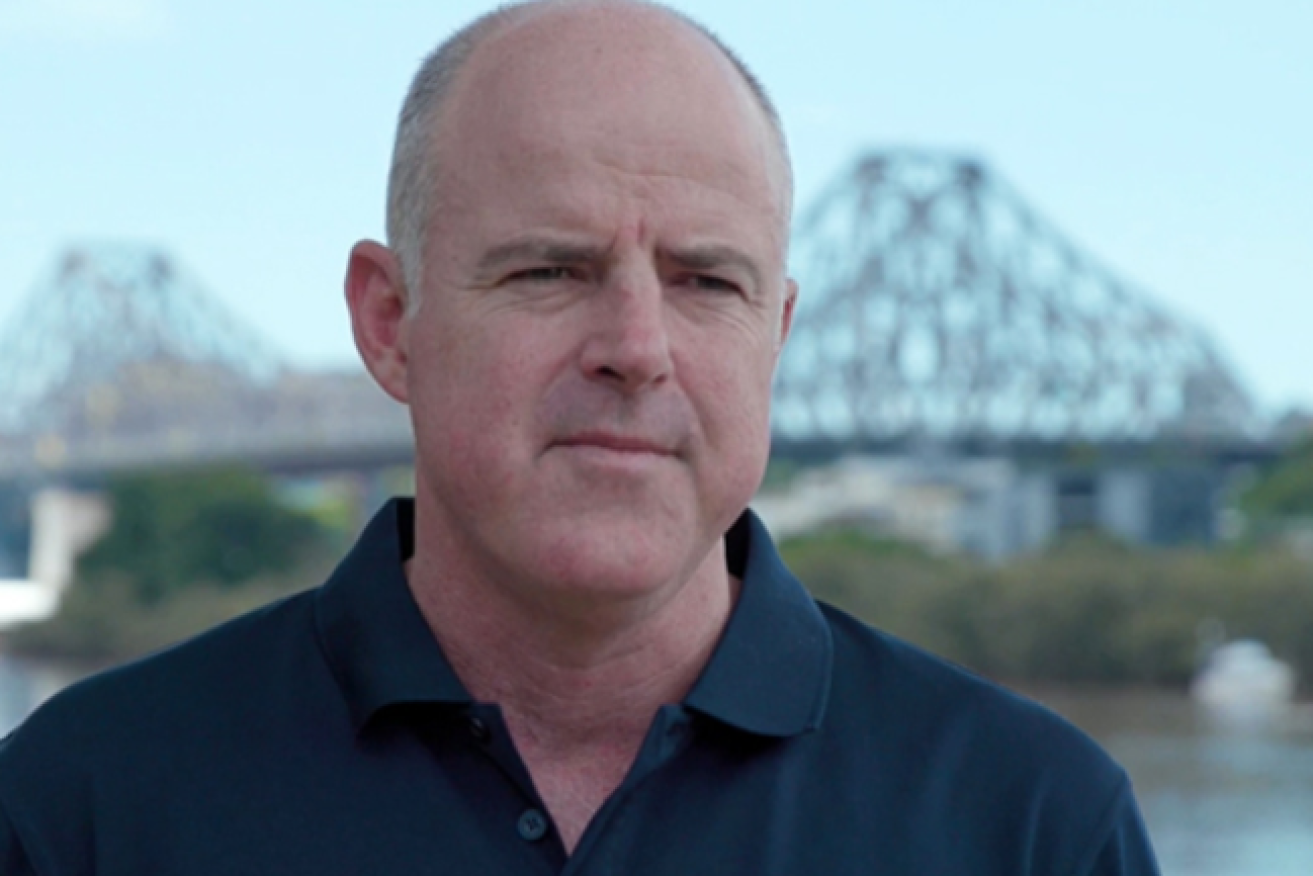

RACQ chief executive David Carter said the club had quit the CTP market

It has previously highlighted that under the scheme’s current model, an insurer cannot choose what risks to underwrite and cannot refuse a motorist who selects them for their CTP. All drivers with the same vehicle class pay the same CTP premium, regardless of their individual risk.

It claimed that because it had a strong brand reputation it had attracted a larger share of riskier vehicles and drivers and this meant its portfolio had a greater proportion of older vehicles, young or inexperienced drivers, shorter policy terms and re-registered vehicles compared to other insurers.

This imbalance meant it experienced higher claims frequencies.

“Put simply, the larger the market share for RACQ, the greater the unfairnesses as we do not receive the appropriate premium to cover our level of risk,” chief executive David Carter said recently.

He said RACQ had built a strong reputation for claims management and was proud of its industry leading claimant satisfaction, but it was no longer viable to continue participating in the scheme.

“The scheme’s design allows for all participating insurers to be profitable, however, this assumes an equitable distribution of risk. In recent years, RACQ’s risk profile has worsened through no fault of our own, resulting in significant losses for the Club,” he said.

“Analysis shows that over the past five years, there is a significant difference between the most profitable and least profitable insurers in the scheme.

“In 2022, for every $100 of premium RACQ received, we paid $123 in claims and expenses due to the increased frequency and severity of claims that the Club received relative to the scheme average. We saw little change in 2023 and in the absence of any changes to the way premium is shared between insurers, the outlook shows no signs of material improvement.”

He said the decision would not compromise or cause any disruption to CTP claimants with a claims process underway or who may have a claim in the future.

“RACQ will continue to provide a claims management service to ensure our existing CTP claimants continue to receive the same high standard of service we are known for, even after our exit from the scheme,” he said.

“We will cease offering CTP insurance cover from 1 October 2023 and RACQ has formally requested our license be withdrawn. ”

All existing RACQ CTP policies remain in place and over the following 12 months, Queensland motorists with RACQ CTP insurance will be transitioned to another insurer on renewal of their registration.