RACQ admits insurance policy blunder; will pay back up to $220 million

RACQ will have to refund up to $220 million to insurance customers over a mistake in the wording of its insurance policies and product disclosures dating back seven years or more.

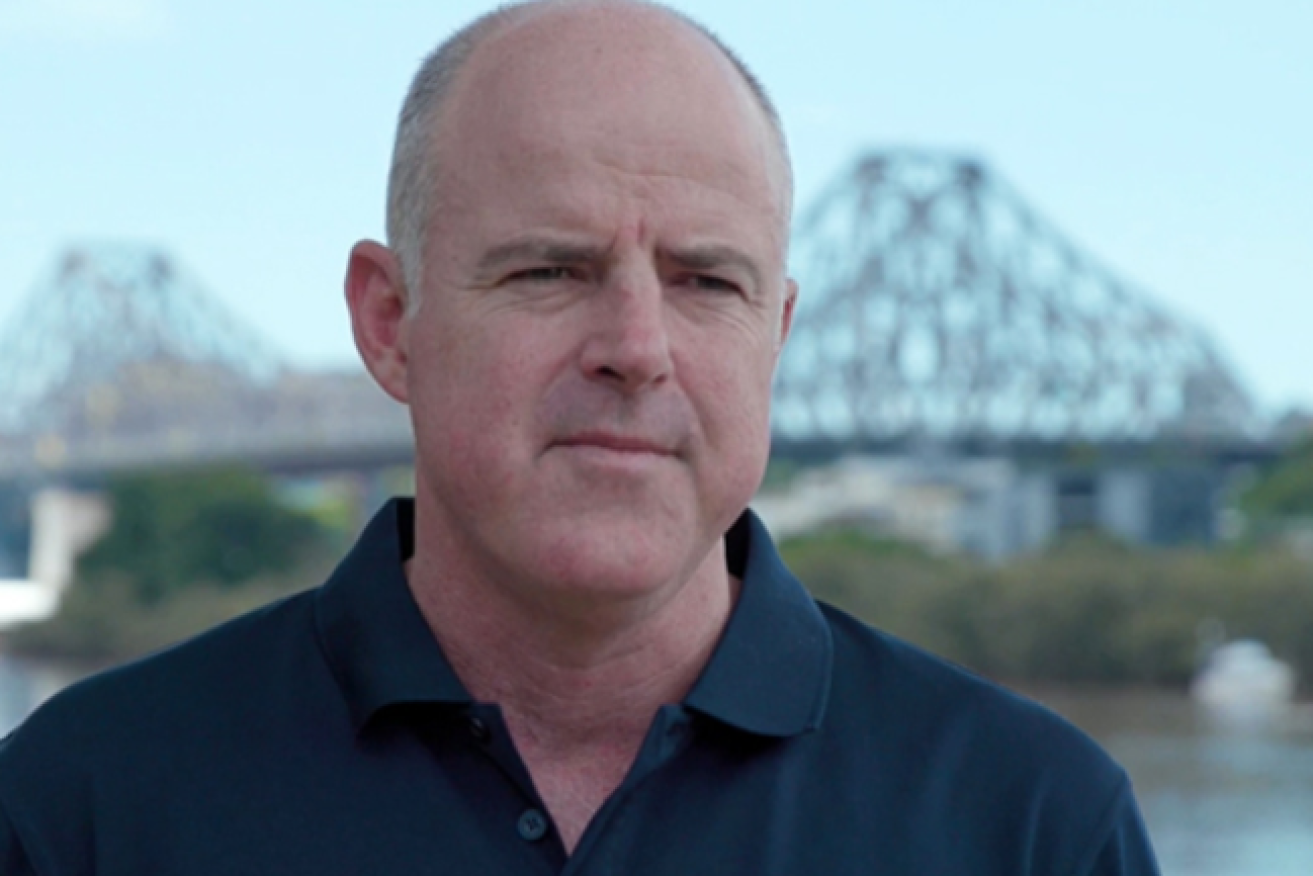

RACQ chief executive David Carter said the club had quit the CTP market

The organisation previously self reported the breach to the Australian Securities and Investments Commission and brought in KPMG, who found “other matters where members did not receive the full benefit of discounts”.

In a letter to policy holders, RACQ said the majority of funds related to the optional covers’ disclosures.

“Up to 500,000 members will receive refunds because our disclosures were incorrect,” chief executive David Carter said.

“We are confident the premiums were calculated and charged to members as intended.

“The total refund to members, across all pricing promising matters, is estimated to be in the range of $200 million to $220 million.

“We will also issue refunds to those members who have not received the discounts they were entitled to, and those refunds may date back to 2013.”

Carter said the refunds would begin in September, but admitted it could take “some time” to complete.

He said the remeditiation program followed and “exceptionally challenging year” for the insurance business.

“RACQ remains financially strong to deliver on its commitments and support its ongoing operations to serve members,” he said.