With the Brisbane Games still eight years away, why are we taking such a short-term view?

Private investment and an innovative, open-minded approach – like tapping our massive superannuation funds – may hold the key to creating a lasting legacy for Queensland’s Olympics, writes David Fagan

Brisbane Lord Mayor Adrian Schrinner poses for a photo during a press conference at Victoria Park in Brisbane. . (AAP Image/Jono Searle)

The solution to Brisbane’s stadiums dilemma is to think imaginatively, tap the private sector for investment and not so hastily reject a bold initiative because a headline figure is hard to justify.

Here’s how it could work: Steven Miles or premier-in-waiting David Crisafulli should bite the bullet and reconsider the $3.5 billion Victoria Park proposal so comprehensively and hastily dumped last week.

They should think of it instead as costing the taxpayer $1 billion and private investors $1.5 billion with the rest funded by debt over 40 years or so.

Then explain to the public (yes, that is a thing) that this is prudent because it’s cheaper than the alternative. It requires spending $1.6 billion on upgrading the Queensland Sports and Athletics Centre which has limited use after the 2032 Games and then $500 million to spruce up the Gabba which will then need a complete rebuild sometime in the next 20 years.

The figures I offer are back-of-the-envelope calculations but they are as reliable as anything else touted in this discussion.

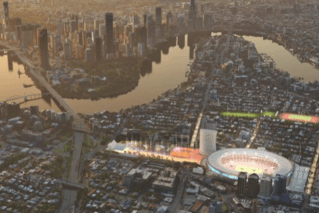

It’s just a fact that hosting the Olympics and Paralympics in 2032 will cost money but the tangible and intangible returns will outstrip the cost if there are visible outcomes. A new stadium as anchor point in a vast new parklands in inner Brisbane is such an outcome.

The passing over of Graham Quirk’s Victoria Park option – without even a hint of due diligence on its costs, the costs of the alternatives and the future opportunities – is a loss to Brisbane that will be long regretted.

But Steven Miles, thinking conventionally rather than innovatively, had little choice given the crisis-charged political minefield he occupies.

Miles and his bureaucrats have a lot on their hands – crime is rampant, housing is in short supply, hospitals are stretched, so are roads and public transit systems. And somewhere north of $100 billion is needed over the next decade to reimagine and rebuild the state’s energy system.

As I’ve written before, who’d be in politics? Well plenty want to be. And away from the cameras, fawning staff and fellow travellers there’s a lot of hard work and a deal of imagination required.

Then there’s the courage needed to take the community on a journey in which they can comprehend and share in solving the challenges. Too few have enough of it. But imagine a world where they did and the community could truly believe these challenges were being met whatever the difficulties.

In that world, Steven Miles and his A-team (and their opponents) might have taken a bit more time to think about what the Graham Quirk committee he had appointed had proposed and looked at the financing options as outlined here.

The cost to the taxpayer would be $1.5 billion not $2.1 billion, with no future cost (and probably a profit) to repurpose the Gabba to fill the housing gap. It could save money, not cost money, leaving billions over the next 15 years for other pressing needs (or to eliminate some debt). And it would provide an A-Grade piece of infrastructure serving the city’s and state’s needs decades into the future.

I would be amazed if such a proposal does not emerge from private sector investors over coming weeks and months.

If Steven Miles wasn’t getting this advice or advice like it, he should be asking his bureaucrats why. If he was and chose to ignore it, we should ask him why.

He might say that Queensland has a long list of failed attempts at public-private-partnerships (and I can recall many such wasted hopes since first writing about them in the early 90s). But past failures only assure future failure to those who can’t learn from them.

Federal Treasurer Dr Jim Chalmers spoke last week to the Business Council about the nation’s challenge to boost investment to maintain its standing and logic says every opportunity to engage the private sector should be seized.

Dr Chalmers has his eyes on one of Australia’s great assets, its superannuation sector, now managing a trillion dollars in retirement saving but open for business to diversify its investment base. A consortium of super funds would be the prime partner to invest in a major inner-city sporting stadium – if they were given the opportunity.

The super sector has boldly invested around the world in all sorts of assets but needs the encouragement to spread its wings out of traditional domestic investments. Although it, too, could do with a dose of courage (but that’s a subject for another day).

I wrote here two weeks ago that this is a city capable of great things. We can look with pride at what’s been achieved over the past three decades but we can’t be complacent.

Queensland is a jewel in a first-world nation. We are capable of dealing with the poly-crises that dominate government action and the media diet.

It’s difficult. And it can be painful. But presented with a big initiative, we need to be ready to give it more than a weekend’s thought. Failure to do so is costly and discouraging, hardly the stuff of an Olympic City.